A friend of mine recently asked how Michael and I were able to afford so much travel. Because I don’t really toss around the term “financial freedom,” I shared with her that it has really been a series of unconventional decisions that have provided us with enough savings to have more flexibility. I also shared that Michael is currently working enough part-time hours that he is able to cover most of our monthly expenses as long as we keep them modest. When reflecting on my response to her a bit later, I started to think through the actual list. What are the lifestyle choices we’ve made that have had such a huge impact on the financial freedom we’ve achieved today?

A friend of mine recently asked how Michael and I were able to afford so much travel. Because I don’t really toss around the term “financial freedom,” I shared with her that it has really been a series of unconventional decisions that have provided us with enough savings to have more flexibility. I also shared that Michael is currently working enough part-time hours that he is able to cover most of our monthly expenses as long as we keep them modest. When reflecting on my response to her a bit later, I started to think through the actual list. What are the lifestyle choices we’ve made that have had such a huge impact on the financial freedom we’ve achieved today?

1. Combining our Finances

I mention this not because it necessarily had a direct impact on our savings, but because it really set the framework for our financial future. When we entered our relationship, I was making a salary of about $30,000 as an elementary teacher and Michael was making about $40,000. Even before we were married, we decided we did not enjoy the complexity of splitting bills, taking turns buying, sharing rent, etc. Although we each had our own savings and retirement accounts, we opened up a new checking account at our local credit union and deposited both paychecks in there.

I know plenty of couples who keep their finances separate, but combining our finances has worked great for us. Our joint accounts have provided us with full transparency of our financial status. Neither one of us has ever felt like we can’t make the purchases that we need or want. Although we don’t have an “official” number, we typically discuss it first if one of us decides to pay for something other than household items that are around $50 or more. Take, for example, The Moth ticket I just bought… can’t wait to see it!

2. Buying Reliable Used Cars

At 37, I have only ever purchased two cars. In 2000, I bought my first one for $1,000 cash from my grandmother after my grandfather passed away. I think the BlueBook value at the time was closer to $3,000, but my grandmother gave me a hefty discount because I was “a good girl”. It was a ‘93 Dodge Shadow that had very low miles and had been meticulously maintained by my grandfather. It reliably got me around town and even rocked a couple cross-country road trips. We finally sold it to one of my coworkers for $400 in 2008. It no longer had any paint on the hood, had no working A/C and it MAY have had some mice living in the ventilation system. We were moving across the country and just didn’t need it anymore.

The car that Michael brought to the relationship became what we affectionately referred to as our “date car”. Compared to the Shadow, it was the fancy one – a ‘98 Saturn SL that he had bought at a used car dealership for $6,000 in 2001. He was told it had been owned by an elderly woman who didn’t drive it much. Ha, just like my Shadow! We know the story was true for at least one of our cars.

We drove that Saturn until it had about 260,000 miles. Those early Saturns were like the Energizer bunny of the used car world. We saw plenty of them on Saturn forums with 400,000+ miles still going strong. That thing would have kept going and going for us, but it did have a few issues. Most notably, the A/C had stopped working and the engine was starting to overheat in traffic. After sitting for an hour on the highway 6 months pregnant and drenched in sweat, I told Michael it was time we get something a little more reliable. You know, for the baby.

Our friend bought the Saturn from us in 2014 for $200 and is still commuting an hour each way through Dallas traffic! Going from <10 mpg to >40 mpg has saved him thousands of dollars in the meantime! 🙂

Look at those two fancy cars!

Commence my first ever car shopping experience. Our top priorities were good mileage, a hatchback trunk, and space for a car seat (maybe someday two!). The one car I DIDN’T want was a Prius. I mean, we were already teased as being “crunchy” by some of our friends, and I worked at a nonprofit that built school gardens. I didn’t need to contribute to the stereotype. We did tons of research and looked at lots of cars, but just couldn’t escape the Prius. It was the only one we could buy used that had everything we wanted. Toyota had been doing the hybrid thing for quite a while, so we were able to find a white 2007 Prius with around 100,000 miles on it for $8,000. We bought it with cash and have been driving it since 2014. I love the damn thing.

So combining all three car purchases over the past 18 years, we have spent about $15,000. A typical car payment is around $500 a month. Every month we resisted car marketer’s campaigns and instead just kept driving our reliable, paid off used car was another month we could stash more cash.

3. Being a One Car Family

We have ostensibly always been a one car couple. Even when we had Michael’s Saturn and my Shadow at the beginning of our relationship, the Shadow went mostly unused since Michael was working from home and I preferred driving the Saturn because it still had all of its paint. The Shadow mostly sat parked in front of the house we were renting just outside of Olympia, Washington. That was the source of the mice problem that my coworker inherited. (We DID tell him).

After selling the Shadow and moving to Texas for Michael’s job in 2008, we still had no need for a second car. Michael always preferred to walk or ride his bike to and from work. I drove the Saturn back and forth to my job. Occasionally, it has been a little inconvenient for one of us to be stuck at home without a car (especially when we were living in a sprawling and unbikeable suburb of Dallas), but not really. We’ve saved thousands of dollars over the years by not having to purchase, insure, maintain, and fuel up in a second vehicle.

4. Living Close to Work

So, we’ve succeeded and failed at this one, but it’s still worth sharing. As I already mentioned, Michael worked from home when we lived in Washington and I was teaching. Originally, we lived in the same town where I taught so my commute was approximately 2 miles. Our last year there, however, we had moved out to the country and my commute was closer to 15 miles one way. It was a drive along Hwy 101 surrounded by trees, water, and backdropped by the Olympic Mountains. I loved that drive!

When we moved to Texas for Michael’s job back in 2008, my employment was still unknown. We were looking to buy a house (this was right at the beginning of the recession and housing prices were nice and low) and we bought in the neighborhood adjacent to his office. Although we had only intended to live there for 2-3 years, we stayed for 8, and Michael always either walked or rode his bike every single day, rain or shine.

About a year after living in the suburbs of Dallas, I landed a job that I loved. The commute was pretty ridiculous and I almost didn’t apply because of it. I did, though, and drove approximately 40 miles each direction for the next seven years. With tolls. And traffic. Ugh. I loved that job, though. : )

5. Buying a Much More Affordable Home Than We Qualified For

By the time we were ready to purchase our first home, Michael and I had maybe 5 – 7 years of saving under our belts and some pretty stellar credit. We were told we pre-qualified for a $750,000 home loan. That much money for a house in the DFW Metroplex would have gotten us a full on mansion. Ya, no thanks. Instead, we found a nice, cookie-cutter 3 bedroom, 2 bath home with a lushly landscaped backyard for $175,000.

I NEVER thought we’d live in the ‘burbs, let alone the suburbs of Dallas, but there we were and we made the most of it. The house was more than comfortable, and at 2,100 sq feet, it was even bigger than we really needed. When Leo came along in 2014, we had our master bedroom, a home office, his nursery, and a spare bedroom for family to visit.

Luckily, by the time we were ready to sell it in 2016, the housing market in the area was exploding, and we sold it within 48 hours for $262,000.

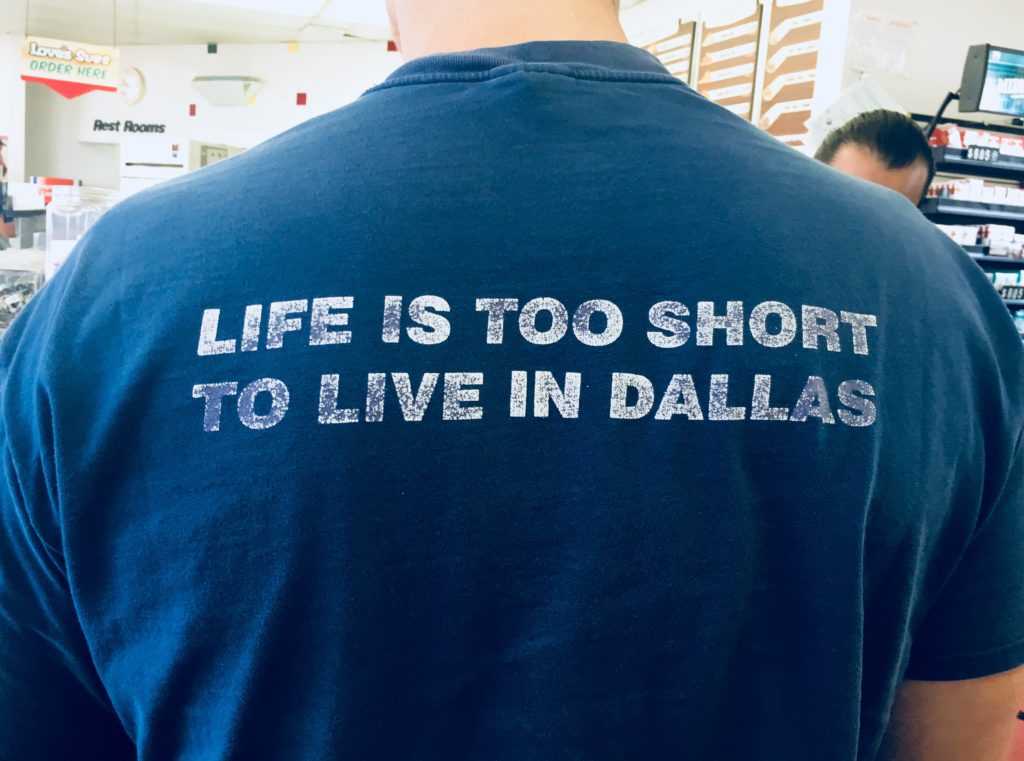

Dallas is a great place to live for many reasons, but we loved the irony of Michael standing behind this guy in line at a gas station on his way from Dallas to Colorado with a Uhaul packed with all of our life’s belongings.

Not surprisingly, housing was quite a bit more expensive in Northern Colorado where we now live, but by then we had over ten years of sound financial decisions that gave us more flexibility. We ended up buying a more expensive home than we were looking for, but the mortgage was still well under the loan amount we could have received. The home suits us great and we can both imagine staying in the home until our kids are grown. We really couldn’t be happier with the neighborhood and location. The homes each have their own 80’s charm, and we can no longer reach across and touch the neighbor’s house from our own! We can walk or bike to just about any daily need, and life is once again backdropped by mountains. Ahh.

Purchasing homes for less than lenders were willing to loan us has easily saved us tens of thousands of dollars in interest over the years.

6. We prioritized paying off the principal on our home loans ASAP

When buying our $175k home in Texas, the smallest mortgage our lender would consider was $100k so we put $75k down. After that, when sending in our monthly mortgage, we’d include a second check with “put towards principal” printed clearly on the front. Early in the life of a mortgage, mortgage payments are applied mostly towards interest. Generally, when paying off a mortgage, loan companies allow you to pay more than the mortgage amount to pay down your principal more quickly. Marking the checks that way ensured our second check wouldn’t just get applied to a future mortgage payment (which would have consisted mostly of interest).

With two incomes, no kids, no car payments, and a relatively modest lifestyle, we were able to chip away at that mortgage amount pretty significantly. It took us two and a half years to pay off the loan and own the house out-right. When we started the process of sending in extra checks to the mortgage company, Michael’s parents starting doing the same for the house they had owned for the previous 15 or so years. With that strategy, they also quickly paid off their home. Before hearing what we were doing, I’m not sure it had ever occurred to them to do so.

At first it seemed insurmountable when we looked at how much we owed. But really, sending in those extra checks each month was so satisfying. Sure enough, our debt just kept getting smaller and smaller, and that motivated us to keep going.

Because of the timing of buying our Colorado home before we sold our Texas home, we took out a mortgage for this house too. But when the capital from the sale of our Texas home became available, we simply applied it all to our Colorado home and were able to pay off our new home in the first month.

7. We didn’t go back to school

After graduating college, I always assumed I would someday return to graduate school to get a Master’s degree. As a teacher in Washington there was some financial incentive to do so as it would provide a relatively significant bump in annual pay. (Why do we pay our educators so little?!) If I hadn’t switched positions to the local nonprofit (that ended up paying me double what I earned as a teacher), I probably would have taken that route. But I didn’t.

I kept waiting for the right time or the right reason to return to school. It was pretty standard practice for our demographic and it felt almost as assumed as an undergraduate degree had been. (I realize this is not the case for many people). Michael also talked about returning to school for an advanced degree. At some point he seemed quite close to applying to a couple local MBA programs.

But we didn’t. Neither one of us was really going to see any change in pay for doing so at our jobs. We were both doing well professionally and an extra degree wasn’t likely to move the needle in any significant way. We already felt so busy, so why throw a student workload into the mix? And, geez, graduate school is so expensive! So, here we are, in our mid (some would say “late”) thirties and we are both happily moving through life with bachelor’s degrees.

Of course, we know LOTS of people with Master’s degrees, and it has made complete sense for them in their contexts. One of our good friends has been in nursing school all 7 years we’ve known her, and each degree has resulted in a significant increase in her professional expertise and pay.

Resisting the urge to pursue master’s degrees without any indication it would impact our compensation has easily saved us tens of thousands of dollars over the years.

8. We wear used clothing

Fortunately for our bank account, I’m not very fashionable. I do enjoy adding a few new articles of clothing to my wardrobe every once in awhile, but that happens once, maybe twice a year. Now that neither of us is working full time, I have switched to shopping only at some of the local resale shops in our town. There are several that specialize in women’s clothing and they are very picky about the pieces they’ll buy from individual sellers. Each piece of clothing is probably $1-$2 more than you’d pay at Goodwill. But their clothes are usually in good condition and often by some of my favorite brands.

Some of our stylish hand-me-down clothes

Michael cares even less about his clothing and would happily rotate through 7 copies of the same shirt. He’s not a big fan of shopping at resale shops, but wears things until they are completely worn out (or no longer pass muster with his wife). He hates clothing brands emblazoned on his shirts and pants. He’d generally prefer a no-name pair of jeans from Costco.

The kids, up until this point, have been dressed almost entirely in hand-me-downs or gifts. We’ve been so lucky in that regard. We get a regular supply of clothes from cousins and some of the mothers in my local moms’ group are always setting aside things to give Marcella. Obviously, kids grow out of their clothes so quickly, so it’s not like you can ever buy them something that you know they’ll wear for many years. There’s an almost limitless pool of used kids clothing out there that people are usually quite happy to pass along for free. Even if you don’t find a good kids clothing “hook-up” there are amazing deals to be found at shops that specialize in kids’ stuff. When there is something we need to buy, I always check one of those places first.

I don’t know what the average family of four spends on clothing, but I’d bet a safe estimate is a minimum of $1000 a year. According to the “clothing” piece of our Mint.com pie chart, we’ve spent $215.04 in the last 12 months.

9. We don’t eat meat

I know this is a touchy subject, but I think it’s worth mentioning. Michael and I have been eating an entirely plant-based diet since 2006 when we read T. Colin Campbell’s The China Study. People often assume it must be so expensive to eat that way. It’s certainly true that lots of fresh, organic produce and fancy, obscure ingredients can contribute to a hefty grocery bill, but those things aren’t necessary. Even when I’m really focused on lowering our grocery bill, I can easily feed our family satiating, nutritious meals. I buy produce at a discount grocery store, stock up on staples at Costco and stay away from some of the elaborate, ingredient-heavy recipes in my favorite cookbooks.

Whenever we have friends or family visiting, I’ll usually pick up some omnivore staples like cow’s milk, sandwich meats, and cheese. Every time I do, I’m blown away by how expensive it all is. Just a pound of ground beef to make pasta marinara or tacos is usually at least $5-$6. Compare that to just the jar of sauce or the dried beans that our family chooses to eat. Michael makes vegan pizza from scratch (dough and all!) almost every weekend. We probably save at least $60 a month by skipping the meat and cheese.

Every year, the average American eats about 200 pounds of meat.

Looking over what I imagine is a fairly standard grocery list of chicken breast, ground beef, lunch meats, block cheese, and eggs, I would guess the typical family spends over $1,000 per year per person on those items. Obviously, we still have to buy things that we do eat, but bread, peanut butter, potatoes, rice, beans, lentils, quinoa, oatmeal, sweet potatoes, etc. just aren’t as expensive. Our household easily saves over $1,000 per year by eating lower on the food chain, before we factor in any health benefits we may derive from eating this way and the resulting reduction in our long-term medical expenses.

While unconventional, none of these lifestyle choices were complicated or difficult. If we hadn’t made some of these decisions, I’m confident we would not have the same financial security we have today. All of those savings have added up, they’ve been invested, and they’ve resulted in real financial freedom.

My first car was a Dodge Shadow and I LOVED it. I have been through many cars since for a lot of different reasons, but of all the cars I owned, the Shadow was probably my second favorite. With the lifestyle changes we’ve made, we’re living close to work and enjoying life as a one-car family, too. 🙂

Yay! Hopefully yours wasn’t from a year that lost all of its paint… ours sure was ugly by the time we stopped driving it. Cheers to the one-car lifestyle. Michael is pretty sure that someday soon car ownership won’t be necessary at all.

Great tips! Buying less house is a great way to get ahead. A bigger house just means more expensive bills. It’s best to get a house that is a good fit.

I disagree with paying off the mortgage early, though. I prefer to invest instead. Either way is better than spending.

I understand your disagreement with paying off our houses early. The math is almost always in favor of not paying off a mortgage early and the recent performance of the stock market only underscores that point. Living in paid off houses has given us peace of mind and simplified our financial lives, but we would have a higher net worth today had we simply invested those additional principal payments in the stock market instead. JL Collins beat this point into my head years ago, but when it came down to it, we looked at the high valuations and political uncertainly and chose to pay off our house nevertheless. As for the decision to pay off our first house, I was 30 at the time and there wasn’t a JL Collins blog yet to talk me down so I’ll cut myself some slack on that one. 🙂

This is a great list. We also paid off the mortgage early by sending in the “apply to principal” checks. It can work out to not pay off the mortgage early and invest, but there is also risk involved. In my mind, it is the same as taking out a loan to invest money the money, just not something I was ready to do. I loved the peace of mind of paying off the debt instead.

Bonnie, me too!