Rat race (noun, an Americanism dating back to 1935-1940):

“any exhausting, unremitting, and usually competitive activity or routine, especially a pressured urban working life spent trying to get ahead with little time left for leisure, contemplation, etc.” (Dictionary.com)

Gallup recently shared the upbeat results of its latest study of U.S. worker engagement — employee engagement is on the rise!

After randomly surveying 30,628 full- and part-time U.S. employees, they concluded the percentage of “engaged” workers in the U.S. rose to 34% for the period ending in June of 2018, tying the record set in March of 2016.

But what does that say about the other 66% of the U.S. workforce?

Gallup grouped the remaining workforce into the following categories:

- Not Engaged: 53%

- Actively Disengaged: 13%

Gallup defines the groups as follows:

- Engaged: Those who are involved in, enthusiastic about, and committed to their work and workplace.

- Not Engaged: They may be generally satisfied but are not cognitively and emotionally connected to their work and workplace; they will usually show up to work and do the minimum required but will quickly leave their company for a slightly better offer.

- Actively Disengaged: Workers who have miserable work experiences.

Over the course of the nearly 2 decades that Gallup has been studying employee engagement, only 30% of employees have been “engaged” with their work on average.

1 out of every 7.7 employees in the U.S. is currently enduring a “miserable work experience”?

And I don’t believe that level of misery remains neatly bottled up in the workplace either. I imagine many people in Gallup’s ‘Actively Disengaged’ and ‘Not Engaged’ groups are enduring miserable lives outside of the workplace — particularly if they don’t have an exit strategy and feel stuck as if they have no choice.

Of course there’s a choice. And we’d best get on with recognizing that and acting on it or we risk mis-living. We each get one life. If we’re not enjoying how we’re spending it, we can always choose to do something else at any time.

I write this article primarily for the disengaged majority.

An Overview of the 7 Strategies

“Before you climb the ladder, make sure it’s leaning up against the right building”. (Stephen Covey)

In this article, I’ll present the following 7 strategies for escaping the rat race:

- The Status Quo Strategy

- The Portfolio Income Strategy

- The Passive Income Strategy

- The Passion Income Strategy

- The Windfall Strategy

- The Sabbatical Strategy

- The Gratitude Adjustment Strategy

These 7 Strategies are like hiking trails. They vary in distance and difficulty. You’re likely more suited to some than to others. They may occasionally converge and you’ll find yourself walking two or more paths at the same time. And you’ll have plenty of opportunities to switch paths altogether mid-journey if you choose.

1. The Status Quo Strategy

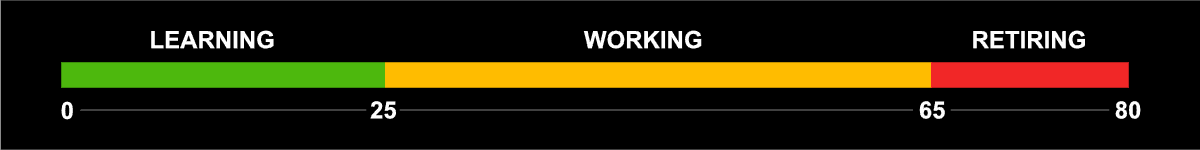

The first way to escape the rat race is to simply follow the most frequented path. To succeed, you must simply work until you die or until an employer or government program affords you a standard of living that enables you to make ends meet without further paid work.

The first way to escape the rat race is to simply follow the most frequented path. To succeed, you must simply work until you die or until an employer or government program affords you a standard of living that enables you to make ends meet without further paid work.

In the U.S., this might look like working until you qualify for Social Security. Or working until you become disabled and qualify for assistance due to your inability to work.

Pensions may factor in as well for part of the workforce. Governments and some other large institutions do still offer pension programs, although their availability has declined sharply in recent decades.

Now, I don’t want to just belittle and dismiss the Status Quo Strategy. It’s a viable strategy for anyone fortunate enough to be a citizen of a country that provides a social safety net for the disabled and elderly.

Even for those of us pursuing the subsequent strategies in this article, the Status Quo Strategy may be an appropriate strategy to revert to during various periods of our lives.

Example: Parents with College-Aged Kids

Consider two parents that reach a level of professional and financial success in their 40s that enables them to finally pay off the student loans they’d each been paying back throughout their 20s and 30s.

After making their last loan payment, they resist the temptation to simply increase their standard of living by the amount of their prior loan payments, and instead increase their saving rate in line with the Portfolio Income Strategy (which we’ll discuss next).

When their kids reach college age though, our example parents then choose to revert to the Status Quo Strategy for a decade, devoting their would-be savings to putting each of their kids through school.

After their youngest child graduates, they again adopt a high saving rate, pursuing the Portfolio Income Strategy with renewed vigor, and still manage to retire in their late 50s.

These example parents are mindfully choosing to fall back on the Status Quo Strategy for that period, knowing it means their kids will then each begin their professional lives free of the burden of student loan debts.

That may mean more to them than an earlier retirement.

Additionally, since their Social Security benefit is based on the average of their highest paid working years, and since they’re nearer to receiving their social security benefit, they likely won’t need as large of a portfolio to successfully fund an early retirement.

While I think many of us can and should aim higher than the Status Quo Strategy, I want to underscore that it may be a viable strategy in various circumstances or seasons of life.

The Primary Advantage of the Status Quo Strategy

Carpe Diem Spending: Since you’re devoting little or none of your monthly income towards saving for the future, all or most of your after tax income is available to be spent.

This could look like the couple above who were able to fund their kids’ college tuition without having explicitly saved for it in advance. Or it might look like funding the most lavish lifestyle within your means (or all too often, slightly above your means). Or any number of scenarios in between.

Some Disadvantages of the Status Quo Strategy

Risk of Reductions to Your Benefits: The primary risk of relying on Social Security or other programs is that the rules of these benefit programs may change due to circumstances completely outside of your control.

The government may decide you must now be even older before you qualify, or they could decide to unilaterally reduce the benefits you had expected to receive.

Your employer may defund their pension program in a bankruptcy, merger, or simply if a callous executive determines it would be more cost effective to litigate with surviving beneficiaries of the pension program than it would be to continue funding it as originally agreed.

The truth is, there may be any number of changes to these programs in the future. This introduces some risk, however small, of reducing or eliminating the safety net you’re counting on.

A Smaller Personal Safety Net: The Status Quo Strategy is often accompanied by a low level of personal savings to rely on if needed. For this reason, many of the other strategies we’ll discuss below are more secure than spending most or all (or more) of what you earn.

2. The Portfolio Income Strategy

The second way to escape the rate race is to accumulate an investment portfolio large enough to indefinitely cover your cost of living. The key to this strategy is accelerating your saving rate.

The second way to escape the rate race is to accumulate an investment portfolio large enough to indefinitely cover your cost of living. The key to this strategy is accelerating your saving rate.

All wealth is built by spending less than you earn.

The conventional wisdom is that workers should aim to save 5-10% of their after tax income for retirement. Few manage to save even that much.

The problem with these low saving rate targets is that you must work for 51-66 years to accumulate enough savings to retire.

Practically speaking, saving 5-10% towards retirement still means working until a government or employer retirement program allows you to retire.

The Portfolio Income Strategy reveals its strength at higher saving rates.

Can you save 25% of your after tax income? If so, you’ve cut your required working years down to 32.

How about saving 50% of your after tax income? Great! Now you’re looking at only 17 working years until retirement.

What if you saved 75% of your after tax income? Then your working years until retirement drops to 7!

But how is it possible to achieve such high saving rates?

Of course, it’s easy for anyone to quickly summarize these factors in a bulleted list. But it can be challenging for some to break the cycle of earning and spending, earning more and spending more.

But if escaping the rat race is your aim, I’d encourage you to see what you can do to save more. You’ll likely surprise yourself.

Some Advantages of the Portfolio Income Strategy

Reduced Working Years until Retirement: For most of us, this is the primary benefit. Maintaining a high saving rate allows you to accumulate a lifetime supply of money in a relatively short period of time.

Improved financial resilience: Month by month and year by year, the Portfolio Income Strategy improves your financial security and your ability to calmly respond to unexpected expenses or shortfalls of income as these circumstances arise.

Just going from living paycheck to paycheck to having a month’s worth of expenses set aside brings considerable peace of mind.

And your financial confidence increases as you go on to accumulate a year’s worth of expenses, then two year’s worth of expenses, and so on.

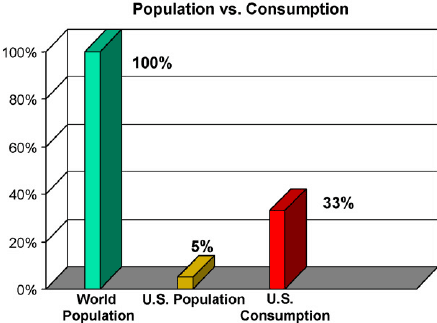

Reduced ecological impact: Cutting consumption isn’t just about saving money. One of humanity’s greatest challenges for the 21st century and beyond is mitigating the deleterious effects on the planet of the high-consumption lifestyles typically associated with industrialized societies.

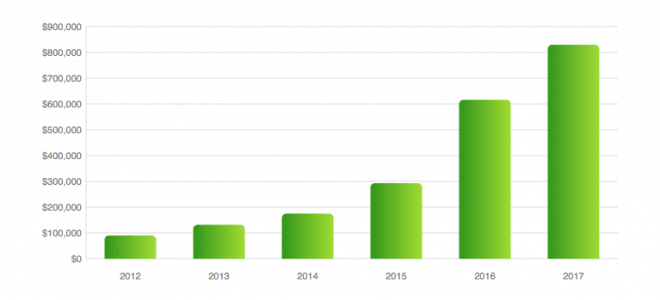

The chart above is from this study by Fulbright Scholar Tony Pereira. In his words, “the human species is on a brutal collision course with its natural environment“.

Ever-escalating cycles of production and consumption are unsustainable on our one finite Earth. And we face the very real risk of turning this planet into a hellish landscape for future generations if we can’t collectively chart a course to a sustainable modern way of life.

Meanwhile, man’s rapacious consumption patterns are being exacerbated by trends like fast fashion, the globalization of western-style eating habits, consumer culture, and our transportation habits with far-reaching consequences.

We can do better than this.

And I believe the FIRE movement, a growing community of people pursuing and promoting early retirement through the Portfolio Income Strategy, is a promising cultural trend in the right direction.

Indeed, one of our primary reasons for starting Uncommon Dream is to promote the cherished early American virtue of frugality and encourage others to second-guess the prevailing standards of mass consumption.

The Portfolio Income Strategy can improve your household’s ecological impact in two crucial ways:

1. Curbing Current Consumption: When people discover that a saving rate of 50-75% makes early retirement possible in 7-17 years, it’s not uncommon for them to immediately reduce their consumption habits.

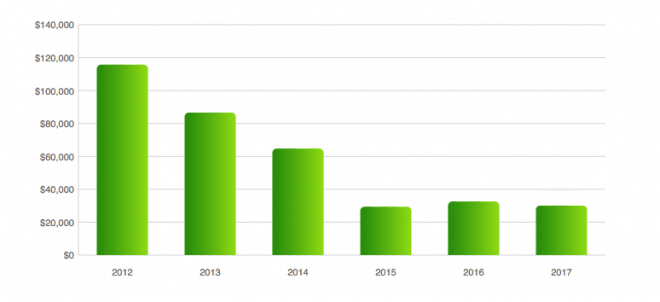

Just read this guest post at Get Rich Slowly contributed by Joel from FI180.com. Joel and his wife reduced their spending from $110,000 per year to approximately $30,000 per year in a matter of a few years after discovering the FIRE movement.

2. Locking In Lower Long-Term Consumption: Many people in the FIRE movement target an investment portfolio equal to or greater than 25x their annual spending. We were no exception.

And after maintaining reduced consumption patterns for years on end in order to accumulate a portfolio of that size, you prove to yourself that you don’t need as much to be happy as you previously might have believed. In Joel’s example above, he quit his job in 2017 with approximately $800,000 saved.

He didn’t wait until he had accumulated $2,750,000 and could safely sustain a return to their original $110,000 annual spending levels.

Instead, Joel decided his time was more valuable than returning to his former high consumption lifestyle.

Some Disadvantages of the Portfolio Income Strategy

Self-Imposed Spending Restrictions: Should you choose this path and begin optimizing your spending habits, you’re likely to encounter several expenses that were making you no happier. It’ll be easy and satisfying to put an end to spending of this sort.

The more difficult matter is the excessive spending in areas that do bring you some short-term satisfaction, but that stand to derail your long-term goal of an early escape from the rat race.

Restaurants, bars, vacations, shopping, and more might fall under this category of spending. If you’re sincerely pursuing the Portfolio Income Strategy, you’ll want to carefully monitor these and other similar spending categories.

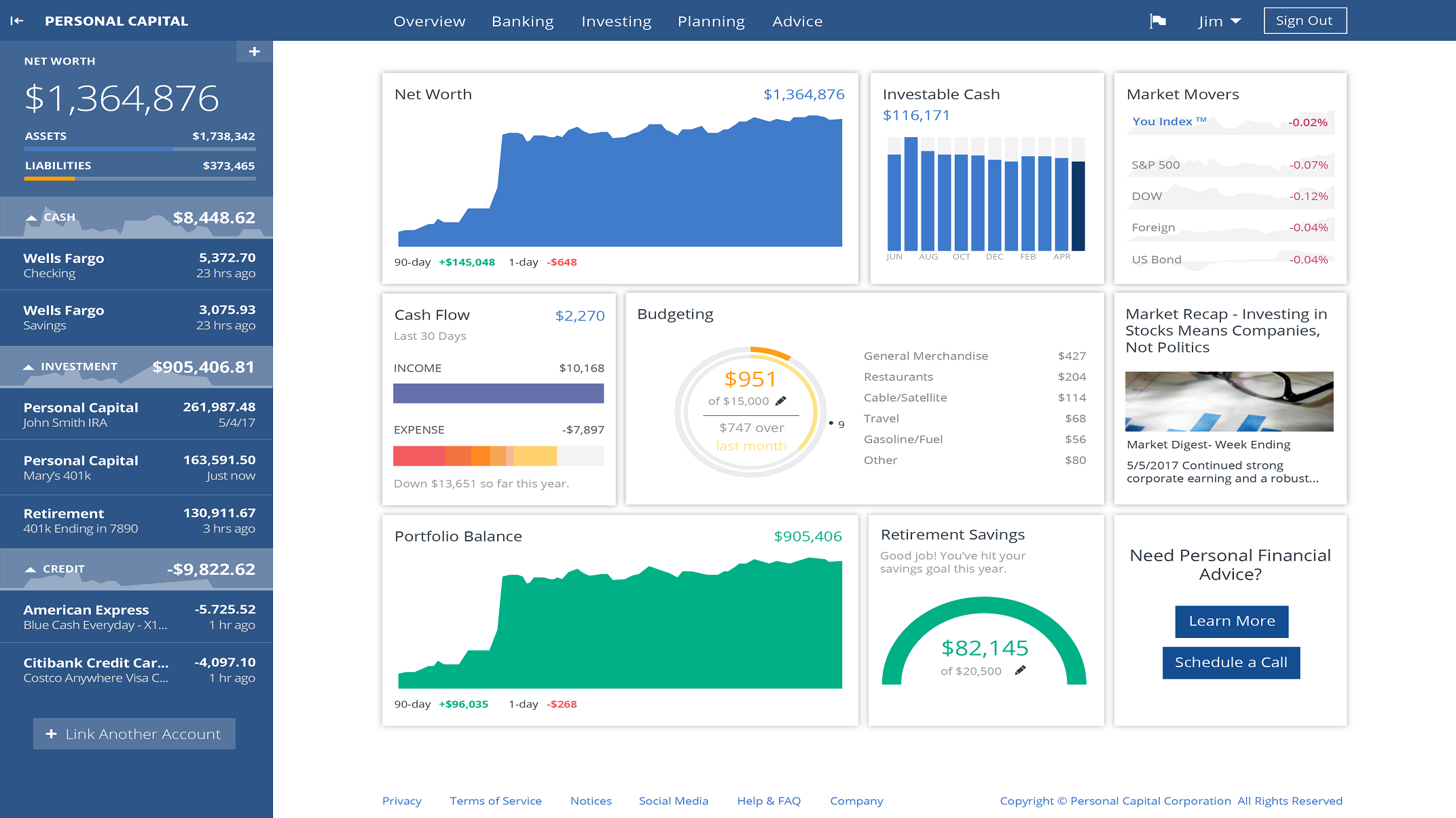

We personally use three tools to monitor and understand our finances. We’ve relied on Mint since 2008, a spreadsheet we developed to give us a bit more insight than we could get with other tools since 2009, and Personal Capital since early 2013.

Nowadays, Personal Capital alone is likely enough to meet most people’s needs:

Once you’re consistently tracking all of your income and expenses, you’ll want to continually revisit and reassess what’s important to you and try to strike the right balance between the short-term and long-term benefits of each choice.

In the words of Paula Pant, “You can afford anything, but not everything. What’s it gonna be?”

The Life-Deferment Trap: Another potential pitfall of the Portfolio Income Strategy is what I’ll call the Life-Deferment Trap. 7-17 years is a swift career by conventional standards, but it’s still a significant portion of your life.

All too often, enthusiastic adopters of this strategy arguably reduce their spending too aggressively, making themselves miserable in the process. Even if they have the will to maintain these levels for the required number of years, doing so may result in unhappiness and regret. Misery is no way to live out this one incredibly precious life.

Ellen and I were lucky enough to maintain sufficiently low spending levels AND fairly high levels of happiness throughout our careers. There’s plenty of joy to be found at lower spending levels if you prioritize it and are willing to constantly conduct little Happiness Experiments on yourself.

For Ellen and me, this looked like a lot of reading, spending time together, and prioritizing friendships with people who enjoyed cheap or free activities like hiking, casual gatherings at each other’s homes, or knocking out various projects together.

As usual, I can count on my friend Carl from 1500 Days to colorfully and vividly get a point across. His article My Death March to Financial Independence is a cautionary tale about getting swept up in the process and forgetting to stop and smell the metaphorical roses along the way.

Common Questions About the Portfolio Income Strategy

How Much Should I Save?

An influential retirement research project commonly known as the Trinity Study or the 4% rule demonstrates the relative safety of simply withdrawing 4% of your starting retirement portfolio per year, adjusted for inflation once your portfolio equals or exceeds 25 times your annual spending.

To quote the authors of the study, “withdrawal rates of 3% to 4% continue to produce high portfolio success rates for stock-dominated portfolios.”

How Should I Invest?

The Portfolio Income Strategy includes those pursuing a variety of approaches to investing, including:

Index Investing: A low-cost investment approach where the aim is to match market returns by investing in mutual funds that passively track a market index.

Certainly do your own research and understand that I’m not an investment advisor, but all of my personal research gave me confidence in the efficacy of index investing with Vanguard or other companies offering Vanguard-like low cost index funds.

I personally began investing in Vanguard index funds in 2004 at age 23. And by investing 50-75% of our income in any given year, Ellen and I were able to accumulate sufficient assets to retire per the 4% rule in our early thirties.

Growth Stock Investing: Creating a portfolio of stocks by actively selecting companies that seem to offer strong earnings growth potential.

Value Investing: Creating a portfolio of stocks by actively selecting companies that appear to be undervalued by the marketplace.

Dividend Investing: Assembling a portfolio of dividend-paying stocks and bonds with the goal of living on the dividend income.

The Permanent Portfolio: Holding a portfolio of stocks, bonds, gold, and cash in equal measure and rebalancing back to a 25-25-25-25 allocation when any one asset class outperforms the others by a predetermined threshold.

Peer-to-Peer Lending: Creating a portfolio of loans made directly to individuals or businesses through online peer-to-peer lending services that match lenders with borrowers.

Real-Estate Investing: Creating a portfolio of income-producing real estate investments.

Chad gave us an early proof copy while he and his family were spending a few weeks with us this summer. I enjoyed the book so much we’ve since bought a copy and had it shipped to a friend of ours in Arizona. And for anyone intimidated by all of the work that goes into managing rental properties, I loved Chad’s Landlording 101 article where he shares in considerable detail the systems, processes, and technology that he and his business partner rely on to manage their real estate portfolio. Incredibly, when Ellen and I met the Carsons in Cuenca, Ecuador, Chad was spending approximately 3-4 hours per month maintaining their 90 rental property units from 2,611 miles away! Perhaps Chad should have named his book The 4 Hour Workmonth!

3. The Passive Income Strategy

The third strategy for escaping the rat race involves earning enough passive income to cover your cost of living. There are many definitions of passive income, but for our purposes here we’ll use the following:

The third strategy for escaping the rat race involves earning enough passive income to cover your cost of living. There are many definitions of passive income, but for our purposes here we’ll use the following:

5 Characteristics of Passive Income

- Distinguishing it from Portfolio Income, Passive Income requires no significant up-front investment of capital.

-

Passive Income does depend on an up-front investment of time and energy.

-

Once established, passive income streams do not require real-time involvement on your part.

-

However, contrary to what the name implies, passive income typically requires some amount of ongoing effort to maintain it. Once established, passive income sources may require up to around 20 hours of ongoing work per week.

-

Passive Income is often made possible by automating recurring business processes such as payment processing, fulfillment, and delivery.

6 Examples of the Passive Income Strategy

1. Creating a business and automating it through outsourcing: This example was popularized by Tim Ferriss in his seminal book The 4 Hour Workweek.

For more on this subject though, I would actually recommend the following books by Michael Gerber over the 4 Hour Workweek, although I found all 3 to be fascinating reads.

- The E-Myth Revisited: Why Most Small Businesses Don’t Work and What to Do About It

- E-Myth Mastery: The Seven Essential Disciplines for Building a World-Class Company

Gerber’s E-Myth books preceded the 4 Hour Workweek and had a big impact on me and my view of an entrepreneur’s role.

Gerber encourages entrepreneurs in any business or industry to avoid simply trading their time for money by working in their business, and to remember to prioritize working on their businesses, developing repeatable processes and automating or outsourcing as many activities as possible.

2. Short-Term Rentals: I briefly touched on real-estate investing above, but it’s worth mentioning again in the context of passive income that isn’t dependent on having significant capital to succeed. Here are two examples of using Airbnb as a source of passive income:

- Renting out your primary residence while you’re traveling: A few years ago we decided to spend our first winter of early retirement in Ecuador and I didn’t like the idea of just leaving our Colorado home empty.

We decided to rent out our home on Airbnb, and we were surprised by how lucrative it was. Our home’s first ever booking was $1,890 for 8 nights! We shared our initial experiences here and here, and we’ve done a fair amount of hosting in the meantime as well.

Now we’ve recently begun our longest trip abroad yet. We’re spending 15-18 months in Latin America in order to give our kids a shot at becoming bilingual before they start elementary school in Colorado.

We’re again hosting on Airbnb to bring in a few thousand dollars of income per month while we’re away, which will likely be enough to cover all of our living expenses while we’re abroad.

How Are Short-Term Rentals a Passive Income Source?

If you’re thinking, “Wait a second! You guys own your home which required an up-front investment of capital!”, well, you’re right. We don’t count our primary residence as part of our investment portfolio and we have to live somewhere, so I’ve included this example.

But without a doubt, owning a mortgage-free primary residence is a big part of what makes Airbnb hosting so lucrative for our family while we’re traveling. And like the example of automating a business that we discussed above, Ellen and I put considerable up-front effort into ensuring everything will run smoothly in our absence.

We’re working with reliable co-hosts who are overseeing everything while we’re away. We have cleaners and backup cleaners lined up. We’ve coordinated which vendors would do what maintenance that might arise and we’ve identified backup vendors.

Our co-hosts once again have contact information for everyone on the team. We’re able to see all of the messages our co-hosts are handling to give us an idea of what’s going on, but we don’t need to be reachable 24/7 in order for everything to keep running smoothly in our absence.

- Managing other people’s Airbnb rentals: For an even purer example of leveraging Airbnb as a source of passive income, read this interview at Mr Money Mustache featuring Zeona McIntyre’s story. Pay particular attention to how she and the team she’s built are serving as Airbnb co-hosts for 10-20 property owners.

Back when that article was published, co-hosting (the practice of managing other people’s properties for them) accounted for approximately $12-$14k of Zeona’s $18,000 per month in Airbnb revenue.

Zeona has done the up-front work of developing repeatable processes and assembling a team to help her do that work. She’s still the big boss, as she says, so plenty of things come to her desk. But she typically puts in about 8-10 hours per week working on Airbnb.

Have you ever considered becoming an Airbnb host? If it’s something you’re interested in, signing up with this link will help support this site.

3. An authority site: For this example, let me introduce you to Kieran.

He earns his living by doing two things well:

He earns his living by doing two things well:

- Sleeping on beds

- Writing about sleeping on beds

<puns> Kieran “covers” all of his living expenses with the passive income he earns through his UK-based mattress review site, the Dozy Owl.

Kieran has worked hard up front to establish himself as a leading authority on mattresses in the UK. Search engines recognize his efforts and trust him to provide valuable mattress advice to his readers.

As such, search engines send a significant amount of UK-based search traffic about mattresses to his site.

In turn, Kieran earns a small commission any time a visitor decides to buy a mattress after reading his reviews and clicking his affiliate links.

When I met Kieran this summer, he was traveling around the U.S. for a couple of weeks. His site was on auto-pilot, earning him enough income to cover all of his expenses while he slept — something he’s clearly passionate about doing! </puns>

4. An ecommerce site selling physical products: Consider the many Shopify stores selling physical goods. The fulfillment of those goods is often outsourced to a third party like Amazon.

And thanks to Shopify’s integration with MailerLite and other email services, it’s fairly straightforward to spend time once automating a series of introductory emails that then go out to every new customer.

We’ve all received these emails, but have you ever considered that this is a completely passive experience on the backend for the shop owners after they develop that email sequence the first time?

Not only that, but these automated emails ensure a consistently high-quality on-boarding experience for customers as well.

5. An ecommerce site selling digital products: While Etsy shops are most known for the sale of crafts and other physical products, there’s been a rise in Etsy shops selling digital goods as well. Again, these digital purchases are fulfilled automatically, this time digitally as emails with download links.

6. Royalty income: Consider the stream of passive income generated through creative works. Books, comics, apps, music, graphics, and so on are all great examples of passive income.

These creative works are sold or licensed through a publisher or marketplace that handles fulfillment and other customer engagement on their author’s behalf.

Stephen King has amassed a fortune from the dozens of books and screenplays he’s written over the course of his career.

Obviously, Stephen King is an outlier example, but there are countless lesser-known creators earning meaningful amounts of passive income from their works as well.

Some Advantages of the Passive Income Strategy

Little to No Up-Front Investment of Capital: There are countless passive income sources you can begin building with little or no money.

Often Faster Than Strategies 1 & 2: With the right set of talents and work ethic, many will be able to create enough passive income to cover their cost of living long before they could through the Status Quo Strategy or the Portfolio Income Strategy.

Low Barrier to Entry: It’s never been easier to develop a source of passive income. You can set up a website for next to nothing and begin publishing globally in a couple hours.

To illustrate my point, our web host Dreamhost has hosting plans starting at $2.49/month! Just think about that for a second and let it soak in.

Consider that reaching a truly global audience was unimaginable throughout all of human history until a few short decades ago, even for the largest of companies. Yet it’s now possible to launch a website for $2.49 or even less today.

Any Plans to Launch a New Website?

If you ever decide to launch a new website, using the links below will support this site at no additional cost to you:

- Shared Unlimited Annual Plan: Using this link, Dreamhost allows me to offer you a $50 discount at checkout for this plan. They actually have a second link to the same plan that pays us double and you none, but I love that they let us pass along half of their affiliate incentive to you instead! ♥️

- DreamPress: Our site is currently hosted on their DreamPress plan, for anyone curious. It’s stood up perfectly to the occasional traffic spikes we’ve received and their support has been great.

Some Disadvantages of the Passive Income Strategy

Considerable Up-Front Investment of Time & Energy: While a large capital investment isn’t necessary, success will often require big investments of time and energy.

You’ll need to choose the hard things again and again despite all of the easier things pulling at your attention.

Low Barrier to Entry: The ease of reaching a global audience also lowers the playing field globally in an unprecedented way. The dramatic reduction in startup friction also means there’s more competition today than ever before.

No Guarantees: Even with a large investment of time and energy, there’s no guarantee there will be interest in what you produce. Or that it will cut through the noise of everyone else who’s competing for your target audience’s attention.

4. The Passion Income Strategy

“I say, follow your bliss and don’t be afraid, and doors will open where you didn’t know they were going to be.”

-Joseph Campbell

The premise of the Passion Income Strategy is to thwart the rat race altogether by designing a work life you’ll never want to escape from.

The premise of the Passion Income Strategy is to thwart the rat race altogether by designing a work life you’ll never want to escape from.

Do you remember that Gallup study we discussed above? Within that “engaged” minority of the workforce you’ll surely find many who are doing work they truly enjoy. Work they wouldn’t stop doing regardless of the size of their paychecks or bank accounts.

Many have escaped the rat race by finding deeply fulfilling work.

An Example of the Passion Income Strategy

Follow Your Bliss: Consider world-famous free-climber Alex Honnold. He’s best known for climbing Yosemite’s 3,000 foot El Capitan wall with nothing more than his clothes and a bag of chalk, an astonishing feat celebrated as perhaps the greatest achievement in any sport.

In this 2015 interview, we meet a down-to-earth guy leading a rather simple existence. His modest lifestyle had long since enabled him to take a shortcut out of the rat race, skipping immediately to doing work he loves doing — rock climbing all day every day.

As his singular focus allowed him to string together one impressive feat after another, his income from sponsorships began covering and exceeding his modest expenses. Rather than dramatically inflate his lifestyle, he instead established a charitable foundation and began donating a third of his income.

And why would he complicate his lifestyle by introducing superfluous luxury?

Alex was already spending every day doing exactly what he wanted to be doing.

Buy an existing business in your desired line of work: It’s sometimes possible to buy a solid business rather than create one from nothing. Your Passion Income might just be someone else’s rat race.

For a variety of reasons (retirement, disability, declining interest), there are a lot of entrepreneurs looking to exit their reasonably successful businesses. But they have no succession plan in place and struggle to figure out how they might transition out of their companies.

I’ve met several entrepreneurs who fit this description over the years. In situations like this, it’s possible to get pretty creative with financing the purchase of their company.

Generally, some cash should change hands, but I have first-hand experience with a 7-figure company that was sold for $100 and a 5-year contract detailing the additional consideration to be paid from the potential future profits over that period.

The only other option that had occurred to the previous owner was to shut the company down. So even the potential of five years of continued income was an attractive enough alternative.

Another friend of mine has built a successful business as a general contractor, but he feels most drawn to the Portfolio Income Strategy.

He similarly struggles to imagine how his business might continue in his absence. Currently, his business is throwing off a few hundred thousand dollars per year in free cash flow.

It isn’t difficult for to me imagine my friend being able to negotiate a win-win scenario with the right partner.

For someone who dreams of getting to spend their days doing carpentry and leading a small team in project-based work, my friend’s business could be their dream job, their passion income.

But he is growing weary of the work and feeling more and more like his business is the rat race he needs to escape from.

Some Advantages of the Passion Income Strategy

Potentially Faster Than Strategies 1, 2, & 3: The popular Parable of the Fisherman & the Banker powerfully illustrates this point.

Joining the Engaged Minority: How much better could your life be if your work life contributed to your happiness?

Some Disadvantages of the Passion Income Strategy

Passions evolve: While you may love your work now, the only constant is change. There’s no guarantee that your 20 year old self and your 40 year old self will find joy in the same vocation.

Circumstances change: Even if you remain devoted to your work, external circumstances are just as likely to change. Economic conditions might devolve. Valued co-workers may move on. A new boss or a merger might introduce a toxic shift in your company’s culture.

5. The Windfall Strategy

“Oh, to win big just once. I swear I know that it would be enough and I’ve had enough.”

Lyrics from Jackpot Stampede Deluxe by Troubled Hubble

(Apple Music, Google Play, Spotify)

(Apple Music, Google Play, Spotify)

No escape from the rat race captivates our society’s collective imagination as much as windfalls. This fifth way to escape the rate race involves creating a sudden increase in net worth.

While we often think first of the unexpected windfalls, there are actually a number of ways that people can actively pursue the Windfall Strategy (beyond just seeking a wealthy partner or the quixotic pursuit of a lottery win).

Some ways to intentionally practice the Windfall strategy include:

Growing & Selling a Business: This might look like starting a business in a growing industry. A growth-oriented entrepreneur might defer taking earnings in the short-term and instead reinvest all earnings in pursuit of the potentially more valuable sale of their company down the road.

Still, I find his example to be an inspiration for entrepreneurs who are growing a business they’d like to sell someday. I believe his success was largely the result of consistently doing one thing well — relentlessly focusing on what was best for his readers. Side note: And for yet another twist in J.D.’s story, almost a decade after selling his blog, he actually bought his blog back from Quinn Street last year. Now he’s resumed writing over there full-time as a retirement passion project. I’ve loved following along.

Working for a Promising Startup: To recruit better talent than they can initially afford, many startups incentivize early employees by offering small percentages of equity or ownership of the company.

Of course, most startups fail. But even a small percentage of ownership of a company that makes it to an initial public offering can result in a substantial windfall. Many fortunes have been made this way for early startup employees.

Further reading: For an example within the FIRE community, check out Adam from Minafi’s recent IPO windfall story.

Student Loan Forgiveness Programs: For more of an outside-the-box example, consider Public Service Loan Forgiveness (PSLF) programs. One popular 2007 student loan forgiveness program was originally designed to incentivize young Americans to go into hard-to-fill public sector jobs.

After 120 payments under a qualifying repayment plan, full-time employees of a 501c3 organization or a federal, state, or local government agency can qualify for…wait for it…100% student loan forgiveness!

However, that student loan forgiveness program notoriously ended up casting a wider net than intended.

Particularly for people with large student loan balances, these programs create a great opportunity to practice the Windfall Strategy.

While high-earning professionals weren’t the original target of such programs, most doctors can qualify for that student loan forgiveness program by working at a 501c3 hospital.

According to the Wall Street Journal article linked above (sorry for their paywall), the U.S. has forgiven billions of dollars in student loans issued to doctors and other white collar workers with particularly expensive educations.

To illustrate the magnitude of these programs’ potential, Travis from Student Loan Planner recently looked at the example of graduating dentists.

To illustrate the magnitude of these programs’ potential, Travis from Student Loan Planner recently looked at the example of graduating dentists.

The American Dental Education Association found that graduates from the Class of 2018 with student loan debt had an average educational debt of $285,184! And many dentists have to borrow even more than that during residency.

After advising hundreds of dentists, Travis says it certainly isn’t unusual for dentists to accrue $400,000 to $600,000 in student loan balances BEFORE beginning their working careers in earnest.

Through this application of the Windfall Strategy, one might live at or below the poverty level throughout medical school and residency, running up large student loan balances in the process. Then by carefully adhering to the requirements of these programs, one can see hundreds of thousands of dollars of student loan debt erased early in their careers.

Travis founded Student Loan Planner back in 2016 to help people with large student loan balances, navigating them through the evolving debt forgiveness landscape as well as sharing a variety of other related tactics.

In the couple of years since, he and his team have directly advised over 1,300 people, saving them a projected $80,000,000 over the life of their student loans through programs like PSLF.

The Primary Advantage of the Windfall Strategy

High Reward: The prospect of a large payout at once is by far this strategy’s most alluring advantage. When executed successfully, the Windfall Strategy has the potential to radically improve your net worth all at once.

The Primary Disadvantage of the Windfall Strategy

High Risk: Businesses fail. Even if you successfully exit a business through a transaction or IPO, valuations might fall far short of your expectations despite all of your efforts. Similarly, legislators might revoke Student Loan Forgiveness Programs with a pen stroke leaving you shouldering that student loan burden on your own.

6. The Sabbatical Strategy

Whether you call it a sabbatical, a mini-retirement, or a leave of absence, the basic premise is the same. Our sixth strategy is about structuring a temporary escape from the rat race.

Whether you call it a sabbatical, a mini-retirement, or a leave of absence, the basic premise is the same. Our sixth strategy is about structuring a temporary escape from the rat race.

For many, the idea of sustaining their demanding work lives for decades on end with little more than a week or two of vacation per year is unbearable.

Sometimes, the best way to escape the rat race is to simply call a timeout, as Stefan Stagmeister shared in one of my all-time favorite TED talks.

During a period of creative stagnation, Stefan found himself questioning the standard script of a 40 year working period followed by a 15 year retirement period.

He wondered if he could cut out 5 of those retirement years and weave them into his working years as follows:

But rather than just dismiss this dream as far-fetched as so many before him, Stefan acted on it.

He closed his design studio for a full year so he and his employees could all take a yearlong sabbatical to refresh their creativity and perspective.

During that year, he and his employees were completely unreachable. Any current or would-be clients instead received this message:

Hello. You have reached Sagmeister Inc.

We are conducting a full year

of experiments and will be back on September 1st 2009.

Please call us then.

The yearlong sabbatical had such a profoundly positive effect on the quality of his next 6 years of work, that he and his team now repeat the sabbatical experiment every 7th year.

Watch the video below to get a sense of the impact their second year-long sabbatical in Bali had on Stefan and his team.

Some Advantages of the Sabbatical Strategy

Near-term relief: Particularly for those enduring miserable work lives, a sabbatical is likely a faster escape from the rat race than any of the options we’ve reviewed so far.

Refresh your perspective: Perhaps the most important advantage of a sabbatical is the chance to get outside of the daily grind and see your life in a new light.

Bandwidth for creative exploration: Many take sabbaticals to pursue passions and interests they struggle to otherwise explore. Occasionally, these experiments lead to sources of passive or passion income.

Some Disadvantages of the Sabbatical Strategy

Opportunity cost: Because of the nature of compound interest, your earlier earning years can make a much greater impact on your net worth than your later earning years, all else being equal.

For a quick example, we’ll project an 8% rate of return. Using the Rule of 72, we can see that our investment is projected to double every 9 years (72 ÷ 8 = 9 years). As you can see below, a hypothetical investor could amass a portfolio of $100,000 by 30 then leave it alone until 93, letting their portfolio double 7 times in the meantime.

| Years From Now | Portfolio Balance |

|---|---|

| Now | $100,000 |

| 9 | $200,000 |

| 18 | $400,000 |

| 27 | $800,000 |

| 36 | $1,600,000 |

| 45 | $3,200,000 |

| 54 | $6,400,000 |

| 63 | $12,800,000 |

Throughout his book The Simple Path to Wealth, author JL Collins regularly cites an 11.9% Rate of Return. An 11.9% Rate of Return sounds implausibly high to me. In Collins’ defense though, he explains that 11.9% was the average Rate of Return over the course of his 40 year investment career (1975-2015).

Here’s our table again, but reflecting JL Collins’ 11.9%. While we’re getting wild here, I’ll go ahead and round up to 12% to give us some easy numbers to work with (72 ÷ 12 = 6 years).

| Years From Now | Portfolio Balance |

|---|---|

| Now | $100,000 |

| 6 | $200,000 |

| 12 | $400,000 |

| 18 | $800,000 |

| 24 | $1,600,000 |

| 30 | $3,200,000 |

| 36 | $6,400,000 |

| 42 | $12,800,000 |

| 48 | $25,600,000 |

| 54 | $51,200,000 |

| 60 | $102,400,000 |

In this example, our hypothetical 30 year old with $100,000 saved could stop investing altogether and still watch that initial $100k compound to become a 9-figure portfolio by their 90th birthday. While this is a simple example and we’ve ignored the impact of inflation (not something you want to do), I hope it illustrates the point.

The earlier you save, the more times you allow your investments to compound. That isn’t to say you shouldn’t take a needed sabbatical. I just encourage you to include opportunity cost in your decision-making process.

Risking Job Security: While many employers will approve sabbatical requests, not all will. And a declined sabbatical request may negatively affect your workplace dynamic, at least over the short term.

Either way, it may also lead an unsympathetic boss to question your future with the team.

Resume Gaps: Particularly with longer sabbaticals, future employers may question these periods of unemployment.

Our Sabbatical Experiences

Many will wonder if sabbatical arrangements are really possible, or just outliers. Well, Ellen and I have taken the following 4 sabbaticals while working for 4 different employers:

Michael:

- 2000: 6 weeks off to study Spanish in Mexico — approved by Michael’s martial arts studio

- 2002: 1 month off to visit friends in England — approved by Dave & Busters

- 2004: 2 months off to study Spanish in Mexico in 2004 — approved by Dave & Busters & Guitar Center

Ellen:

- 2006-2007: 1 school year off to study Spanish in Mexico — approved by Ellen’s public school principal

In every one of our examples above, we were guaranteed our jobs would be held for us until we returned. At least for hard-working and valuable employees, I believe sabbaticals are a very real possibility.

Just put yourself in the employer’s shoes. Wouldn’t you rather approve a sabbatical than lose a valued employee?

Jillian and her husband have taken 5 such mini-retirements in the last 15 years ranging from a month to 2.5 years. Through her blog and coaching, Jillian guides people through mini-retirements and intentional living.

7. The Gratitude Adjustment Strategy

“Cultivate the habit of being grateful for every good thing that comes to you, and to give thanks continuously. And because all things have contributed to your advancement, you should include all things in your gratitude.”

― Ralph Waldo Emerson

The last thing I want to do with this article is discourage anyone. Yet, there are those among Gallup’s Actively Disengaged group that might review the strategies I outlined above and still feel despair.

The last thing I want to do with this article is discourage anyone. Yet, there are those among Gallup’s Actively Disengaged group that might review the strategies I outlined above and still feel despair.

If none of the above strategies resonated with you, I’d like to share a seventh way to escape the rat race that is available to all.

Gratitude.

I know, I know. But I’m being sincere. The rat race is, after all, a mental construct. It’s a prison of the mind.

I believe a deficiency of perspective is responsible for much of the misery found in modern first-world work lives.

If you’re reading this, I’m confident you’re already among the world’s most privileged minority. And you enjoy freedoms that are the envy of much of the world.

I’ve been speaking with Venezuelans for online Spanish classes 30-90 minutes a day for the past month. Many Venezuelans are struggling to meet their basic needs for food and other essentials. Today, minimum wage in Venezuela is below $5 USD per month and declining.

I spoke with a woman a couple night’s ago who’s sleeping 5 hours per night and working 3 jobs in order to earn the equivalent of $12 USD per month.

Spend 4 minutes briefing yourself on the Venezuelan crisis and recall that it was the richest country in South America earlier this century. Stable economies and stable governments are not guaranteed.

You probably don’t spend much time being grateful for either, but I’d encourage you to look around the world and smell the macroeconomic roses.

Is your work-life stressful? Do you feel overworked or undervalued? Good news! You’re free to work elsewhere.

“You have brains in your head. You have feet in your shoes. You can steer yourself any direction you choose.”

– Dr. Seuss, Oh, The Places You’ll Go!

When you dwell on the negative things in your life, you feed that negativity while simultaneously restricting your awareness of the positive.

On the other hand, being grateful for all the good in your life can have exactly the opposite effect, limiting the power that negative events have over you.

The right perspective can inspire feelings of gratitude. Gratitude can elevate your perspective.

If you’re reading this, you’re probably human. If so, you’re unbelievably lucky to be members of the species currently sitting atop the planet’s food chain.

To understand just how different conditions on Earth could be for human life, take a look at Madagascar. When it split off from continental Africa some 165 million years ago, all plant and animal life in Madagascar set out upon a unique path of evolution.

For but one of many fascinating examples, watch this short video showcasing the remarkable specialization of our distant cousin, the Madagascan Aye Aye.

There was never any guarantee that our species of primate would become Earth’s apex predator. On a more oxygenated Earth, for example, insects might grow much larger, making human life inconceivably more frightening.

Consider how fortunate we are that our daily existence doesn’t include dealing with mosquitos with 6 foot wingspans.

You can go for a hike without worrying about a mosquito’s proboscis plunging through your heart and completely draining the blood from your body over the course of a few minutes.

Yum. Moving on…

Align Yourself With The Mission

If you weigh the options I’ve summarized in this article and decide remaining at your job is your best option but you’d just like to be happier there, consider reconnecting with your company’s mission.

All businesses exist to help others.

Now, I’m not arguing that all businesses are morally equivalent. But to be in business, your organization must be providing value to someone. Identify those beneficiaries and frame your efforts as a service to them.

For example, I imagine working for a big insurance company might at times be frustrating drudgery. It’s easy to see how people could become apathetic and see their work as little more than pushing papers all day.

But it can be uplifting to stop and consider that perhaps some of those pieces of paper represent families whose homes have burned down — families who avoided financial ruin thanks to the paper you pushed.

If you can’t align yourself with the mission of the company, you really should consider working elsewhere. If you do marketing for a big tobacco firm, your company still has a mission. You just might find that mission deplorable.

Move on and use your talents elsewhere. Work someplace where you can feel good about the contributions you and your company are making to society in your way.

Some Advantages of the Gratitude Adjustment Strategy

- Universally available to all: Anyone can practice gratitude at any time.

- Most Immediate Benefits: The benefits of gratitude can be immediate.

Some Disadvantages of the Gratitude Adjustment Strategy

- Impermanence: The benefits of gratitude are as fleeting as they are immediate. For best results, gratitude must become a constant practice.

Whatever path you choose, I hope you incorporate gratitude in your journey.

If you’ve read this far and found any of this helpful, please let me know in the comments below!

Good luck and godspeed!

Escaping the rat race really comes down to building awareness, increasing income flexibility, and making intentional financial choices. One thing that helped me was clearly understanding my long-term financial independence numbers and how much I actually need to sustain my lifestyle. Tools like https://coastfire-calculator.com/

can make this process much clearer by showing how savings and investments grow over time. Small, consistent steps today can create real freedom later.

Really enjoyed this post, especially the reminder that escaping the rat race doesn’t have to happen overnight. I’ve been exploring Coast FIRE lately as a more balanced approach, and this tool has been super helpful for running the numbers coastfirecalculators.com. Thanks for the great insights and motivation!

Really enjoyed this post, especially the reminder that escaping the rat race doesn’t have to mean quitting everything overnight. I’ve been looking into Coast FIRE lately as a more balanced approach, and this tool has been super helpful for running the numbers: coastfirecalc.com. Thanks for the great insights and motivation!

I found this article very enlightening. I do agree with the last point (i.e., gratitude). I guess before anything else, any person must gain clarity in what he wants before he finds it. Thanks a lot for the all the well studied insights. I really saw the value in reading this.

This would only work for middle class and “rich” people who have money to fall back on! What about us low skilled, working class folks with kids who already work multiple jobs and live less than from paycheck to paycheck (in debt)? These methods would never work and aren’t practical. How about some articles for us?

Absolutely – it reads from an entitled, privileged perspective with the qualifier ‘oh we know we’re privileged and now I’ve just written it down in this blog so it’s okay’ It’s patronising for someone to say ‘Step 1. Have a mortgage free property you can rent out. Step 2. Go abroad’

Wow! While all 7 of these strategies resonated the Gratitude Strategy was particularly powerful for me! Thank you for the beautiful reminder to apply perspective to our 1st world problems and appreciate the “rat race” we are fortunate enough to live in.

I’ll be posting this section of the article in my office as a constant reminder, thank you for the inspiration!

Jennifer,

Thanks so much for your kind words. I’m really honored to hear you printed and posted part of my article. Thank you!

Such a helpful article at a time in my life where considering all these options is top-of mind.

I am an early career physician who recently decided to take a personal unpaid leave of absence from sub-specialty medical training after finding out I was not successful at my main specialty’s certification examination this summer.

The time off I am currently undertaking is primarily intended to afford me the time to study and achieve success on the aforementioned exam; however, its unpaid nature, amidst my current circumstances, have stimulated me to reflect deeply on how I might optimize the career, financial and personal aspects of my life, moving forward.

In this context, reading your article’s sections on passive income, windfall, sabbatical and gratitude strategies have validated my recent thoughts and feelings on this subject, and provided me with a clearer perspective on what it is I need to do, moving forward.

So helpful (and potentially life changing)!

Thank you! 🙂

Thanks, Marcelo! I love getting comments like this, of course. They’re these beautiful little artifacts and reminders of my past efforts.

I believe you’ll similarly find that the results of your hard work today — of taking the time to reflect and then engage fully in this most important undertaking — will pay dividends in distant moments of your life. I believe your future self will enthusiastically tip his hat in gratitude to 2020 you!

While writing this article, I of course hoped it would be read and appreciated, just as you’re striving to enhance your trajectory through good old fashioned hard work and doubling down on your certification exam studies. Good luck, Marcelo!

This article has provided me with much hope for my financial future. Thank you and God speed! :0)

Cheers, Todd — good luck!

This is a very well written article. Thank you very much for sharing this MIchael. I particularly enjoyed the gratitude strategy. Reminded me a little bit an interview with a friend who turned into an artist/animal-activist.

Thank you, Michael, for this excellent post and its many useful links.

I particularly appreciated the Gratitude Adjustment Strategy and was so glad that you decided to include it. In fact, when I read the initial list, I was most intrigued to see what you’d have to say on this topic.

Gratitude can be such an important part of our path, as well as in our reflection about the path we’ve already trod, and in our celebration as we reach milestones along the way; however, I seldom see it included in FI discussions. For me, your inclusion of this key was like the “secret spice” that gave this post its distinctive, delicious flavor.

Thank you again, and best wishes to you and the family in your Columbia-leg of the adventure!

Cheers, Damon! Thanks for stopping by.

Wonderful article. Thanks for the great perspectives, specially the last one; because everyone is on the journey to one of the first 6 and living the 7th one while getting there is so important.

Thanks for the encouragement, David!

Wow, what an epic post! There is a lot to digest here.

We are finally at a stage where we paid off our consumer debt and are trying to figure out where to put our money. Do we pay off our mortgage ASAP or focus on investing in index funds? I know the math favors investing, but there is something about getting rid of that mortgage that is hard to explain. I’ve got a post scheduled to publish in a few weeks that goes through the numbers and our thoughts.

There is a lot I want to investigate further after reading this article. Thanks for sharing.

I too have deliberated over paying off our house vs investing in the market with both of the homes we’ve owned. The first home was a starter home and we took out a relatively small mortgage. When the economy seemingly started imploding around us in 2008-2009, I was self-employed and had to go a few months without paying myself.

Although we had plenty in savings at the time to handle that dramatic downturn in the market, the experience convinced me to focus on paying off our mortgage as quickly as we could to reduce our monthly expenses. I believed it would make us a little more resilient the next time something like the Great Recession presents itself.

With our 2nd house in 2016, I viewed the market as overvalued and decided to use the proceeds from the sale of our first home to avoid carrying a mortgage on the 2nd home. I’m not a big fan of market timing at all and typically just invest in the market and let it do its thing. But with a few $100k to invest in a hot market all at once, I failed to resist that market timing mindset.

From the vantage of 2019, I can now see clearly that in both of those cases, the math has clearly favored carrying those mortgages and NOT paying off our homes (i.e. we would have a higher net worth today had I opted not to pay off either or both of our homes).

Still, both times that decision brought us plenty of peace of mind so I don’t really regret making either choice.

Chris, we chose the path of paying off our mortgage. It is a decision that is very liberating and one you will never regret. Good luck!

Interesting take on the “status quo strategy.” I wonder, though, if its primary advantage—stability—outweighs the potential for long-term regret. Is it *really* escaping the rat race?

Great post. As an active member of the rat race (with little possibility of that changing anytime soon), I’ve been concentrating mostly on method #7 while I get my act together on my other methods of choice. With 40-something years (20 since college) of (mostly) feeding the negativity, retraining my mind is a long process. Your perspective reminder was very timely for me.

Thanks. (<- meant sincerely)

I went back and forth on whether or not to include that 7th strategy and your comment makes me so glad I did. Cheers!

I also checked out your site and read your recent “Hey, Jealousy” post — https://www.dadsanddollars.com/hey-jealousy/#more-264

Two things:

1. You might find it useful to remember the snowball effect. We intuitively think of saving up the first $100k as 10% of the way to $1,000,000. Because of compound interest however, saving up that first $100k is actually a much larger percentage of the time it will take you to save $1,000,000. Those first years feel like a slog, but then your investments will start chipping in more and more. I don’t know what your current net worth is and am not asking. I just wanted to remind you to be patient with the process and remember that every single step along the way is bettering your financial freedom.

2. When you find you’re comparing yourself to others (I struggle with this too in plenty of areas), I find it useful to fix my attention on metrics like my own saving rate and the year-over-year changes in our net worth.

I hope that helps. Thanks again for taking the time to stop by and comment!

Awesome post, Michael! It’s cool to see this written from a financial perspective. I would say I’m currently enjoying a converging cocktail of #s 2,3,4,6,7.

I write about slow and simple living and have outlined some examples of converging strategies like:

Geographic Arbitrage + Downsizing + Downshifting + Voluntary Simplicity + Slow Living

Even just within downshifting, one could do:

Consumption Downshifting + Lifestyle Downshifting + Career Downshifting

The possibilities and combinations are endless, but each one you add compounds your momentum!

Thanks again!

Kyle

Thanks for the feedback, Kyle! I walked around your site a bit and feel we’re definitely birds of a feather.

Your recent article about everyone talking about Geographic Arbitrage lately made me laugh. I too recently gave a talk about it at CampFI Southeast and wrote a guest post about Geographic Arbitrage over at Get Rich Slowly: https://www.getrichslowly.org/geographic-arbitrage/

XD

Epic post, Michael! Very well done.

After the frankly exhausting description of disengagement in and outside work, I appreciated your paragraph: “Of course there’s a choice. And we’d best get on with recognizing that and acting on it or we risk mis-living. We each get one life. If we’re not enjoying how we’re spending it, we can always choose to do something else at any time.” So true.

I like how you distinguished between portfolio income and passive income, which is in turn different from passion income. I’m ‘escaping the rat race’ with a mix of portfolio and passion income myself; doing some fun jobs and working on building some passion projects while on a year-long mini-retirement of travel around USA – subsidised by dividends from my portfolio.

As much as Mr Money Mustache and Vicki Robin espouse it, I don’t think the FI/RE community talks enough about reducing consumption as a force for good – arguably necessary for the environment going forward. I agree that the more people reducing their consumption to increase savings as part of the pursuit of rat race escape, the better for the planet. I feel we need to complement this reduced consumption with making sure we aim for the best consumption too; choosing the greenest goods and food, plus considering ethical and environmentally friendly investment options too. Thanks for including reference to this in your 7 ways post.

That’s a lovely comment. Thank you, Michelle! I feel those two strategies in particular — portfolio income and passive income — have a tendency to get conflated. I put a fair amount of thought into how we might distinguish between the two more usefully. I’m glad to hear you found it useful!

Escaping the rat race really comes down to building awareness, increasing income flexibility, and making intentional financial choices. One thing that helped me was clearly understanding my long-term financial independence numbers and how much I actually need to sustain my lifestyle. Tools like https://coastfire-calculator.com/

can make this process much clearer by showing how savings and investments grow over time. Small, consistent steps today can create real freedom later.